Therefore the person that is selected as the successor trustee will oversee that all the property in the trust will transfer to the beneficiary at the time.

Living trust california online.

Get a living trust plus legal advice for 2 weeks after purchase.

Cancel anytime 299 get an attorney.

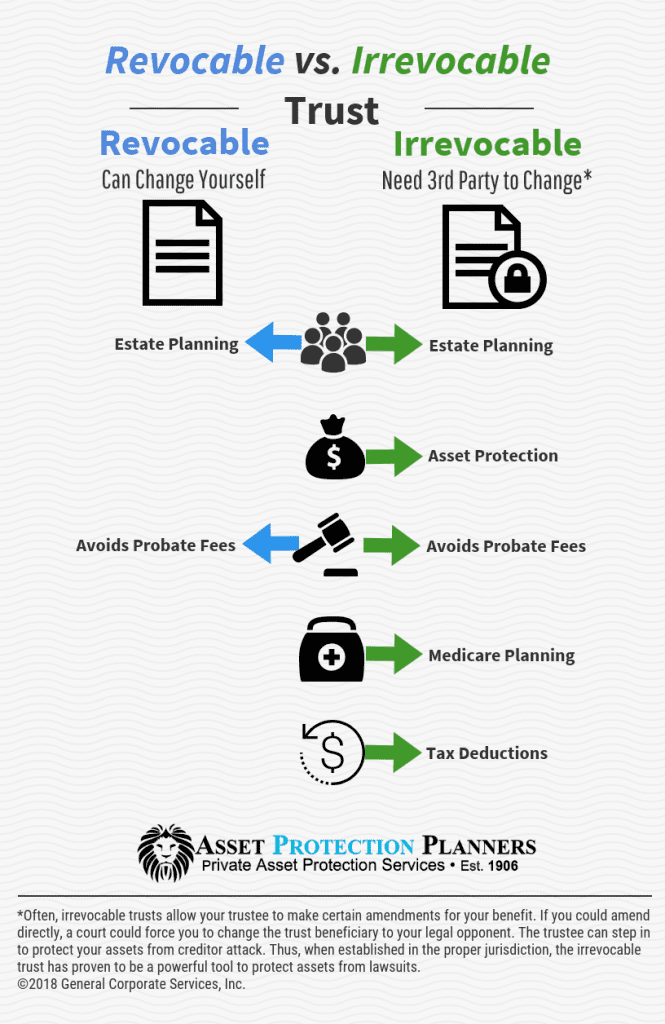

Unlike a will a trust does not go through the probate process with the court.

Wills often are used to designate how assets that are not included in the trust are to be distributed.

Nolo s living trust 2021 lets you protect your family without the hassle and expense of probate court.

With nolo s living trust 2021 you can create.

Legal advice renews monthly at 14 99.

A california living trust is a legal document that places some or all of your assets in the control of a trust during your lifetime.

The california revocable living trust is a document that allows a grantor to specify how his her assets and property should be managed during their lifetime and after their death the assets designated to the trust may be managed by the grantor only if the grantor chooses to act as trustee person responsible for maintaining the trust however this option is only available with a revocable trust.

A living trust is a document that allows individual s or grantor to place their assets to the benefit of someone else at their death or incapacitation.

California does not use the uniform probate code which simplifies the probate process so it may be a good idea for you to make a living trust to avoid california s complex probate process.

Living trusts and taxes in california.

However california does have two procedures that fast track the probate process for smaller estates using simplified probate processes.

After your death the living trust california assets are passed to the people you have.

A living trust is just one part of your estate planning.

A living trust will likely not have a huge impact on your taxes in california.

Sometimes people don t move all their assets to the trust or obtain properties after the trust is created so they need a way to dictate how those assets are to be disbursed.

A living trust lets survivors transfer property quickly and easily to the people who inherit it.

At the state level there is no estate tax or inheritance tax in.

Download the california living trust form which allows you to create a separate entity to hold your chosen assets and property which will continue during your life and after your death until the assets are distributed a trustee of your choosing is obligated to administer the trust in a manner which is in the best interest of your beneficiaries.

Shoppers will find two affordable options for their specific living trust needs including an e book with detailed instructions on how when and where to create a living trust for 17 95.

Or shoppers can choose from a more helpful option at 67 95 that allows them to actually create their living trust online like many of the other companies.

As the person creating the trust you can dictate.

:max_bytes(150000):strip_icc()/NOlo-1715995a5c634d1b84d8c1a6770764ae.png)